Your SMSF can borrow money to buy assets like shares and property, providing you access to investments you may not otherwise have been able to purchase. It can also borrow money to fund payments. There are, of course, strict rules governing what and how an SMSF can borrow.

The super laws prohibits an SMSF from borrowing money, except in these specific circumstances:

- to fund a payment to a beneficiary – in which case, the borrowing can’t exceed 90 days;

- to cover the settlement of securities transactions – and then only up to seven days;

- to pay a superannuation surcharge liability – the borrowing can’t exceed 90 days; and

- to acquire an asset under a ‘limited recourse borrowing arrangement’.

From September 24, 2007, the super laws were amended to allow super funds to enter into limited recourse borrowing arrangements to acquire permitted assets. This change in the law effectively provided certainty in relation to the use of instalment warrants. However, the law now also permits the application of these arrangements to a broader set of assets. The law was further amended in July 7, 2010.

Super gearing

The best known example of gearing in superanuation, formally known as a Limited Recourse Borrowing Arrangement, is an instalment warrant over shares. These arrangements can now also be used to acquire other assets such as property or managed funds, effectively allowing the SMSF to gear investments via super. There are a strict set of requirements that must be followed.

The key rules are:

- The loan must be for a single asset, or a collection of identical assets with the same market value, that the SMSF is otherwise permitted to acquire. A property with one title, or a number of shares in the one company would qualify. Shares from different companies would not qualify.

- The asset must be held on trust for the SMSF – that is, the SMSF is the beneficial owner.

- The SMSF must have the right to acquire legal ownership of the asset by making one or more loan repayments.

- The lender’s only rights (for example, in the case of a default on the loan) are limited to the asset itself (hence, “limited recourse”).

- The acquirable asset cannot be subject to any charge, other than that provided through the borrowing arrangement.

- The borrowed money cannot be applied to improving the asset.

- Only in very limited circumstances can an acquired asset be replaced by another acquirable asset.

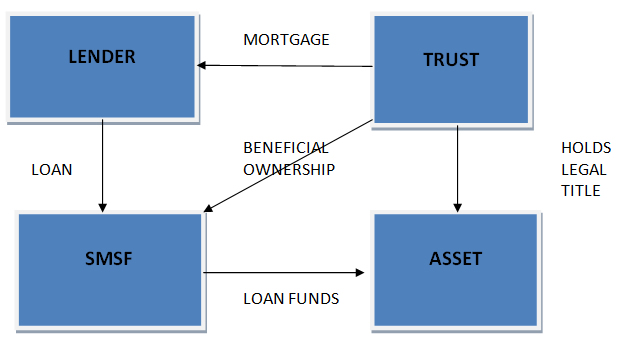

The borrowing arrangement will have the following structure:

Any borrowing arrangement that the SMSF enters into will need to satisfy the sole purpose test, and can’t be used for existing assets. Only new assets can be acquired under these arrangements – existing assets of the SMSF cannot be transferred into these arrangements.

The rules relating to the acquisition of assets from related parties apply, which means your SMSF cannot borrow money to purchase a residential investment property from a related party (see acquisition of assets from related parties). Further, the property acquired can’t be improved or enhanced during the life of the loan, regardless of who provides the finance or cash to make such improvements.

Due to the replacement restrictions, the SMSF is not permitted to dispose of part of the assets (for example, to sell a parcel of the shares), or participate in a dividend re-investment plan. Dividend income can be used to repay the principal or interest on the loan.

Lending

Your SMSF is not allowed to provide any form of financial assistance, including loans, to a member of the SMSF or a relative of the member. There are no exceptions to this prohibition.

Loans to members (often unintentional) are a common problem in SMSFs. Any loan improperly made must be repaid immediately, and potentially, the fund compensated by a payment of interest at a commercial rate for the lost income for the period of the loan. As the loan is a breach of the SIS Act, the ATO may initiate compliance action against you.

Important information: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. For this reason, any individual should, before acting, consider the appropriateness of the information, having regard to the individual’s objectives, financial situation and needs and, if necessary, seek appropriate professional advice.